Property Tax For Overland Park Ks . The city’s budget is supported by property and sales taxes, along with fees for services and. As a public service, we offer a land records. The johnson county property tax division serves as both the county clerk and treasurer. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. Overland park has the lowest property tax rate of any comparable city. Enter address, reference number, kup number or parcel number to search. The tax rate for properties in overland park and blue valley schools is 107.157 mills. I calculated that number from the spreadsheet above. Property taxes are levied on real estate and property, and help support services including: However, it can also be found. To pay bills, view statements and print receipts search here: The core responsibilities are tax calculation, billing and. 21 rows overland park’s property tax rate is 14.525 mills. Johnson county tax office > property detail. The state’s average effective property tax rate (annual.

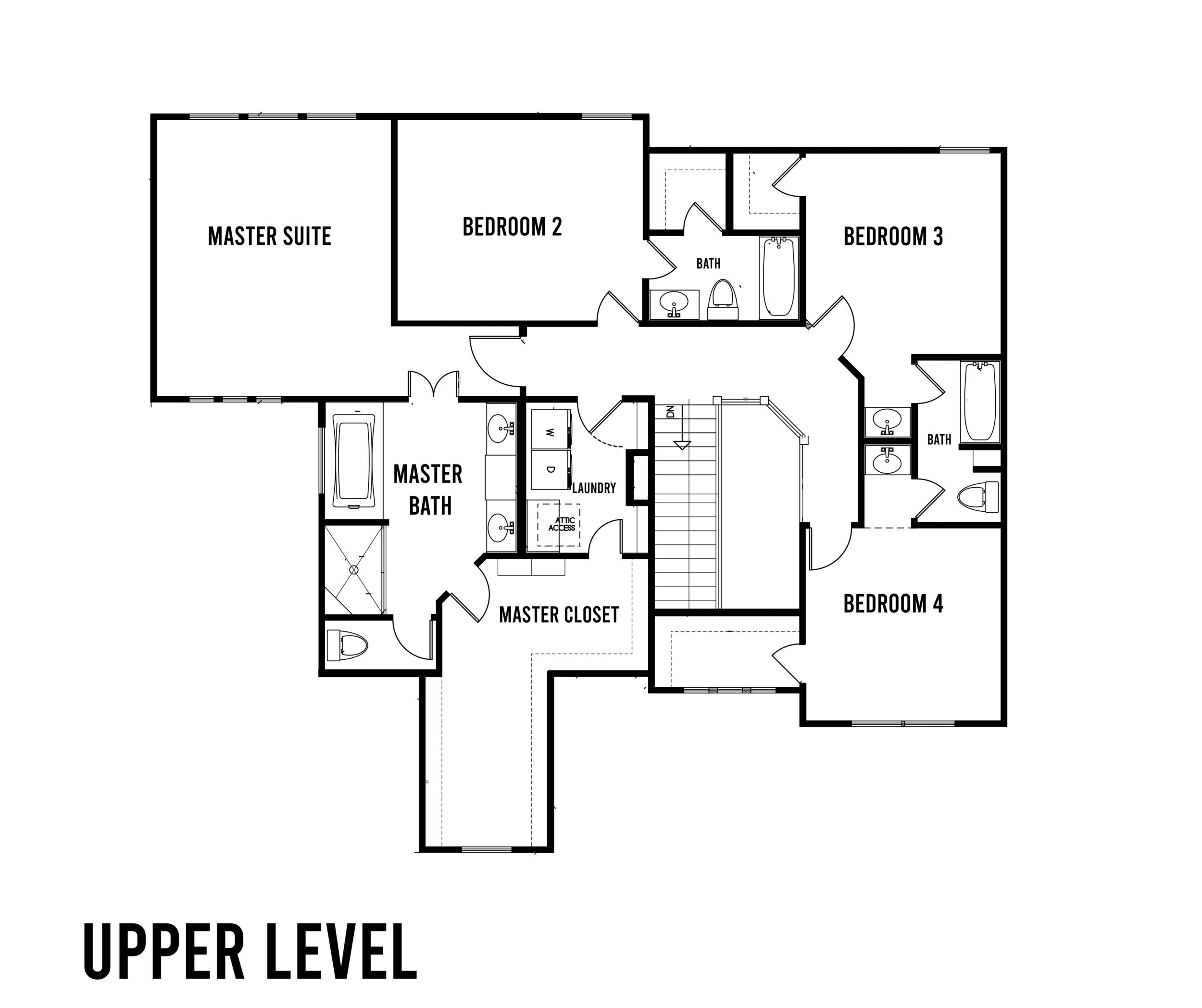

from sabhomes.com

Property taxes are levied on real estate and property, and help support services including: The core responsibilities are tax calculation, billing and. The tax rate for properties in overland park and blue valley schools is 107.157 mills. Overland park has the lowest property tax rate of any comparable city. Johnson county tax office > property detail. The johnson county property tax division serves as both the county clerk and treasurer. I calculated that number from the spreadsheet above. The state’s average effective property tax rate (annual. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. As a public service, we offer a land records.

18612 Howe Drive, Overland Park, KS 66085 SAB Homes

Property Tax For Overland Park Ks The city’s budget is supported by property and sales taxes, along with fees for services and. 21 rows overland park’s property tax rate is 14.525 mills. Enter address, reference number, kup number or parcel number to search. The tax rate for properties in overland park and blue valley schools is 107.157 mills. The state’s average effective property tax rate (annual. Property taxes are levied on real estate and property, and help support services including: Overland park has the lowest property tax rate of any comparable city. To pay bills, view statements and print receipts search here: The city’s budget is supported by property and sales taxes, along with fees for services and. As a public service, we offer a land records. Johnson county tax office > property detail. The core responsibilities are tax calculation, billing and. However, it can also be found. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. I calculated that number from the spreadsheet above. The johnson county property tax division serves as both the county clerk and treasurer.

From www.reecenichols.com

5808 W 129TH Street, Overland Park, KS 66209 2415325 ReeceNichols Property Tax For Overland Park Ks The johnson county property tax division serves as both the county clerk and treasurer. The core responsibilities are tax calculation, billing and. The tax rate for properties in overland park and blue valley schools is 107.157 mills. Enter address, reference number, kup number or parcel number to search. As a public service, we offer a land records. Johnson county tax. Property Tax For Overland Park Ks.

From sentinelksmo.org

Overland Park 2022 budget deceit and a 10 property tax hike The Property Tax For Overland Park Ks Overland park has the lowest property tax rate of any comparable city. The tax rate for properties in overland park and blue valley schools is 107.157 mills. The core responsibilities are tax calculation, billing and. However, it can also be found. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly. Property Tax For Overland Park Ks.

From metropropertyinspection.com

Home Inspection in Overland Park Metro Property Inspection Property Tax For Overland Park Ks The state’s average effective property tax rate (annual. To pay bills, view statements and print receipts search here: 21 rows overland park’s property tax rate is 14.525 mills. Overland park has the lowest property tax rate of any comparable city. However, it can also be found. Johnson county tax office > property detail. Property taxes are levied on real estate. Property Tax For Overland Park Ks.

From www.youtube.com

Luxury Home Tour Overland Park Kansas YouTube Property Tax For Overland Park Ks The core responsibilities are tax calculation, billing and. The city’s budget is supported by property and sales taxes, along with fees for services and. Johnson county tax office > property detail. To pay bills, view statements and print receipts search here: While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly. Property Tax For Overland Park Ks.

From www.reecenichols.com

4523 W 97th Street, Overland Park, KS 66207 2420922 ReeceNichols Property Tax For Overland Park Ks Overland park has the lowest property tax rate of any comparable city. However, it can also be found. The core responsibilities are tax calculation, billing and. As a public service, we offer a land records. The state’s average effective property tax rate (annual. Enter address, reference number, kup number or parcel number to search. I calculated that number from the. Property Tax For Overland Park Ks.

From www.loopnet.com

11620 W 95th St, Overland Park, KS 66214 Property Tax For Overland Park Ks To pay bills, view statements and print receipts search here: Enter address, reference number, kup number or parcel number to search. The state’s average effective property tax rate (annual. The core responsibilities are tax calculation, billing and. Property taxes are levied on real estate and property, and help support services including: Johnson county tax office > property detail. The tax. Property Tax For Overland Park Ks.

From www.apartments.com

The Lakes at Lionsgate Apartments Overland Park, KS Property Tax For Overland Park Ks Johnson county tax office > property detail. The state’s average effective property tax rate (annual. The johnson county property tax division serves as both the county clerk and treasurer. Property taxes are levied on real estate and property, and help support services including: The core responsibilities are tax calculation, billing and. As a public service, we offer a land records.. Property Tax For Overland Park Ks.

From rentbits.com

Apartments and Houses for Rent in Overland Park Property Tax For Overland Park Ks Property taxes are levied on real estate and property, and help support services including: While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. Overland park has the lowest property tax rate of any comparable city. 21 rows overland park’s property tax rate is 14.525 mills. The state’s average effective. Property Tax For Overland Park Ks.

From sentinelksmo.org

Property taxes jump again but help is on the way The Sentinel Property Tax For Overland Park Ks As a public service, we offer a land records. Overland park has the lowest property tax rate of any comparable city. The core responsibilities are tax calculation, billing and. However, it can also be found. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. The tax rate for properties. Property Tax For Overland Park Ks.

From activerain.com

Overland Park Reverse Ranch for sale Property Tax For Overland Park Ks The core responsibilities are tax calculation, billing and. Enter address, reference number, kup number or parcel number to search. The city’s budget is supported by property and sales taxes, along with fees for services and. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. I calculated that number from. Property Tax For Overland Park Ks.

From www.loopnet.com

11740 W 135th St, Overland Park, KS 66221 Quivira Crossing Property Tax For Overland Park Ks 21 rows overland park’s property tax rate is 14.525 mills. Johnson county tax office > property detail. The state’s average effective property tax rate (annual. Property taxes are levied on real estate and property, and help support services including: However, it can also be found. As a public service, we offer a land records. Overland park has the lowest property. Property Tax For Overland Park Ks.

From solarpowersystems.org

Top Solar Companies in Overland Park, Kansas 2024 Save Money with Property Tax For Overland Park Ks Enter address, reference number, kup number or parcel number to search. 21 rows overland park’s property tax rate is 14.525 mills. The city’s budget is supported by property and sales taxes, along with fees for services and. Overland park has the lowest property tax rate of any comparable city. The tax rate for properties in overland park and blue valley. Property Tax For Overland Park Ks.

From fox4kc.com

Overland Park council approves 200M tax deal for massive Brookridge Property Tax For Overland Park Ks The city’s budget is supported by property and sales taxes, along with fees for services and. The tax rate for properties in overland park and blue valley schools is 107.157 mills. Enter address, reference number, kup number or parcel number to search. The core responsibilities are tax calculation, billing and. However, it can also be found. As a public service,. Property Tax For Overland Park Ks.

From exprealty.com

13224 W 182nd Street, Overland Park, KS, 66013 eXp Realty® Property Tax For Overland Park Ks Property taxes are levied on real estate and property, and help support services including: I calculated that number from the spreadsheet above. 21 rows overland park’s property tax rate is 14.525 mills. However, it can also be found. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. The johnson. Property Tax For Overland Park Ks.

From activerain.com

5220 W. 158th Place Overland Park, KS Homes for Sale Property Tax For Overland Park Ks The johnson county property tax division serves as both the county clerk and treasurer. 21 rows overland park’s property tax rate is 14.525 mills. The tax rate for properties in overland park and blue valley schools is 107.157 mills. Property taxes are levied on real estate and property, and help support services including: Overland park has the lowest property tax. Property Tax For Overland Park Ks.

From www.apartments.com

The Village Apartments Apartments in Overland Park, KS Property Tax For Overland Park Ks The core responsibilities are tax calculation, billing and. The tax rate for properties in overland park and blue valley schools is 107.157 mills. I calculated that number from the spreadsheet above. Johnson county tax office > property detail. Overland park has the lowest property tax rate of any comparable city. The state’s average effective property tax rate (annual. Enter address,. Property Tax For Overland Park Ks.

From activerain.com

Where is 66204 in Overland Park KS? Property Tax For Overland Park Ks 21 rows overland park’s property tax rate is 14.525 mills. Overland park has the lowest property tax rate of any comparable city. The city’s budget is supported by property and sales taxes, along with fees for services and. The johnson county property tax division serves as both the county clerk and treasurer. As a public service, we offer a land. Property Tax For Overland Park Ks.

From www.pinterest.co.uk

Overland Park, Kansas Area Map Light HEBSTREITS Sketches Area Property Tax For Overland Park Ks Property taxes are levied on real estate and property, and help support services including: Overland park has the lowest property tax rate of any comparable city. 21 rows overland park’s property tax rate is 14.525 mills. The core responsibilities are tax calculation, billing and. However, it can also be found. To pay bills, view statements and print receipts search here:. Property Tax For Overland Park Ks.